Selling My Home

Great Deals

Property Search

Foreclosures

Income Property

New Construction

Downtown

Neighborhoods

Condos

Rentals

Investor Central

Real Estate Blogs

Resources

Testimonials

Webcams

Client Log-in

Contact Us

Just The Facts, Jack

Fort Lauderdale & South Florida Housing Market Stats

2024 Year End Real Estate Statistics

Median Home Price in Fort Lauderdale Rises to $657,000

The Median Sale Price for a Single Family Home in Fort Lauderdale actually rose 2.3% to $657,000 through a sluggish real estate market which continues to consolidate after the steep increases we have seen in home values over the last few years.

The South Florida Metro reporting area comprised of Miami-Dade, Broward and Palm Beach Counties reported a 7.1% increase in home values, the Median Price for a Single Family House going up to $635,000 according to the 2024 Year End statistics released by Florida Realtors, which are generated by compiling numbers reported through the MLS of local realtor associations throughout the Sunshine State. Only the Sebastian-Vero Beach Metro in Indian River County reported a higher percentage gain, the Median Price there rising 8.4% to $420,000.

Overall, the Median Sale Price in Florida rose...

Continue reading and see pdfs of the Official Statistical Reports from the Florida Association of Realtors, click link below.

2024 Real Estate Market Stars

Official 2023 Year End Statistics Reported by Florida Realtors

Fort Lauderdale Home Prices Show Strength and Resilience

After shooting up 14.3% in 2022, following the astounding increase of 36.2% in 2021 and 18.9% in 2020 the Real Estate Market in Fort Lauderdale finally took its long-awaited breather in 2023, according to Year End statistics released by Florida Realtors, generated through compiling numbers reported through the MLS of local realtor associations throughout the Sunshine State.

Frankly we expected the market to cool off through '22, but they remained strong.

In 2023 the Median Sale Price of a Single Family Home in Broward County increased 5.5%, to $580,000 from $550,000 in 2022.

In the Condominium and Townhome market, the Median Sale Price went up 9.2% in Broward County, from $250,000 in 2022 to $273,000 in 2023.

Though not eye-popping like we have become used to, those are still pretty good numbers, showing resilience and strength given the tight market conditions, a double-digit decrease in Closed Sales and abnormally high mortgage rates.

Local Real Estate is currently working its way through a period of...

Continue reading and see pdfs of the Official Statistical Reports from the Florida Association of Realtors, click link below.

2023 Real Estate Market Stars

Ft Lauderdale Real Estate News 5/15/2024

The Nostradamus of Property Values?

Paul McCartney Predicts Latest Real Estate Trend in 1964

The United States Census Bureau has released Net Domestic Migration statistics tracking who is moving from where to where in the country, from state to state, from county to county. It's basically that old Beatles song: people are following the sun.

In addition, they are also following the taxes. To be more precise, they are fleeing high taxes and not surprisingly relocating to cities and states with lower taxes.

According to some statistics Florida is still the fastest growing state in the nation. Other stats indicate it might be...

Continue reading, click link below.

2023 Net Domestic Migration

Official 2022 Year End Statistics Reported by Florida Realtors

Fort Lauderdale Home Prices Show Appreciation of 14.3%

You Call That a "Down" Year?

Following a staggering rise of 36.2% in 2021, and 18.9% in 2020, the Real Estate Market in Fort Lauderdale was supposed to take a bit of a breather. And we suppose you could say it did. According to 2022 Year End statistics released by Florida Realtors, data generated by compiling sales reported through the MLS of local realtor associations throughout the Sunshine State, the Average Sale Price for a Single Family Home in the city of Fort Lauderdale only rose 14.3%.

Yes. ONLY 14.3%.

Which raises two interesting questions:

The first – what kind of Real Estate Market are you in when 14.3% appreciation is considered a "down" year?

The second – why is anybody investing in Real Estate anywhere else?

With mortgage rates high and inventory tight, following two years of explosive growth, you would expect Real Estate to cool off, consolidate, as people became accustomed to the new pricing reality.

Apparently, in Fort Lauderdale, that translates to 14.3%.

An even more telling stat, perhaps, is the...

Continue reading and see pdfs of the Official Statistical Reports from the Florida Association of Realtors, click link below.

2022 Real Estate Market Stars

Ft Lauderdale Real Estate News 1/31/2023

Highest Increase in Home Values in U.S.

Florida ranked Number One in home price appreciation last year, according to recent statistics released by real estate website Zillow showing the rise in property values from January to January.

According to their analysis, the average price for a home in Florida rose $56,000 through 2022, from $345,305 in January of last year to $405,939 in 2023.

That represents an increase of 17.27%, meaning home values...

See Larger Image, Read Entire Story

Fort Lauderdale No. 1in U.S.

Florida Realtors 2021 Year-End Statistics

Fort Lauderdale Homes Up A Whopping 36%

The Average Sales Price for a Single Family Home in Fort Lauderdale rose a staggering 36.2% in 2021. In addition, the Median discount from Listing Price was Zero, meaning the vast majority of homes either sold for full asking or more than the Listed Price.

These startling figures are according to the latest year-end statistics released by the Florida Association of Realtors. Though seemingly incredible on face value these are accurate numbers. Statistics released by the Florida Realtors are generated by compiling sales reported through the MLS of local realtor associations across...

Continue reading, click on button below

2021 Year End Real Estate Statistics

Florida Realtors Year-End Statistics

Ft. Lauderdale Home Values Rise 19% in 2020

Home values in Fort Lauderdale rose 19% in 2020.

To be precise: the Median Price of a Single Family Home in Fort Lauderdale, Florida increased to $500,000, which represents a rise of 19.0% from the previous year, according to statistics compiled and released by the Florida Association of Realtors.

What makes statistics reported by the Florida Realtors particularly valid versus other market reports...

Continue reading, click on button below

2020 Year End Real Estate Statistics

Some Charts you might find interesting

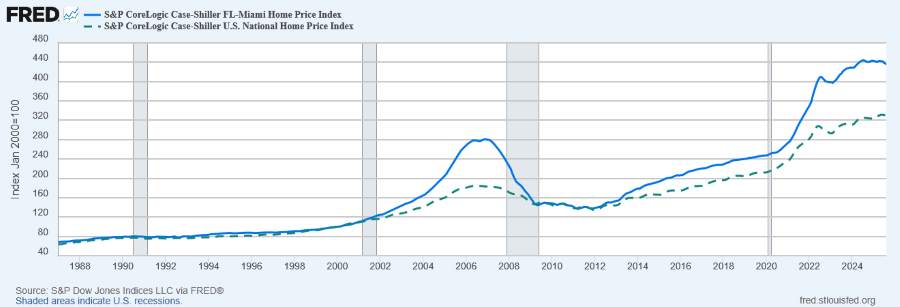

Freddie Mac Home Price Index

Blue Line is latest S&P Case-Shiller Home Price Index for South Florida Metro Reporting Area

(Miami-Dade, Broward and Palm Beach Counties)

Dotted Line is Home Price Index for the U.S.

Shaded Areas on Chart represent U.S. Recessions

Total Tax Burden by State

Run Cursor over map to see where each State ranks.

Real Estate Taxes

Run Cursor over map to see where each State ranks.

Net Domestic Migration

Run Cursor over map to see where each State ranks.

Research Florida Real Estate Statistics

Click Button below, go the Research & Statistics Page

of the Florida Association of Realtors.

Florida Market Reports

Many Reports are Publicly Available. Some are Members Only.

Should you be interested in a report which is only available to Association Members,

feel free to give me a call. I'll be happy to download one for you.

It's not like this stuff is Top Secret or anything.

Coming Soon Listings

Not Active on MLS Yet

Before they appear on big Real Estate sites

Click Button Below

Sneak Previews

Get A Head Start

On Your Home Search

5 Star Rated Realtor

Internet Marketing Expert

Click This Button to See

What Clients Say

About Jim Esposito

LIST YOUR HOME

with

The Best Realtor in Ft. Lauderdale

Click The Button Below to Receive a Complimentary

Property Evaluation

Of the Market Value of Your Home!

Before You List

You Should Read

10 Tips to Boost Home Value

Real Estate Pros Share Valuable Insights How To Get The Most for Your Home

Increase Home Value

Fort Lauderdale Beach Webcam

Click Image See Live Webcam

Ft Lauderdale Home Value

ANALYSIS & PROJECTIONS

Real Estate Projections

A Comprehensive and Intelligent Consideration of What's Ahead For The Local Real Estate Market

FREE MLS ACCOUNT

Save Listings

Saved Searches

Email Alerts & Updates

Client Log In

Registration Required

Most Recent Real Estate Statisics

Fort Lauderdale, Broward County, South Florida, Statewide & Beyond

Just The Facts

Latest Statistics

Home Buyer Assistance

Programs Offered

by Broward County

& The State of Florida

Make It More Affordable

to Buy A House

Find Out More!

Homebuyer Programs

Sitio en Español

Site en Français

Site em Português

Seite auf Deutsch

CEOs & Founders

of

For Sale By Owner

Buy Owner

Craigslist

List THEIR Homes

with

Realtors!

Read About It Here

Like – I Know What I Say, But Now We're Talking

MY MONEY!